The taxman may be coming after your profits if you resold tickets this year.

After such high-priced events as Taylor Swift’s “Eras Tour,” the IRS is looking to get its piece of the resale pie.

A new law has companies like Ticketmaster and StubHub reporting users to the IRS if they sold more than $600 worth of tickets this year, The Wall Street Journal reported.

It doesn’t matter if the person reselling the tickets turned a profit, only that they sold tickets worth more than $600, Fox Business reported. If they made a profit by selling it for more than they originally paid, the ticket seller would have to pay additional taxes.

The average price for Swift tickets was $1,095. Beyoncé's tickets went for $380 and Harry Styles were $400, according to the newspaper.

The reporting threshold was changed from $20,000 via 200 or more transactions to $600 under the American Rescue Plan Act. The IRS will issue guidance for taxpayers who may receive the 1099-K form, Fox Business reported.

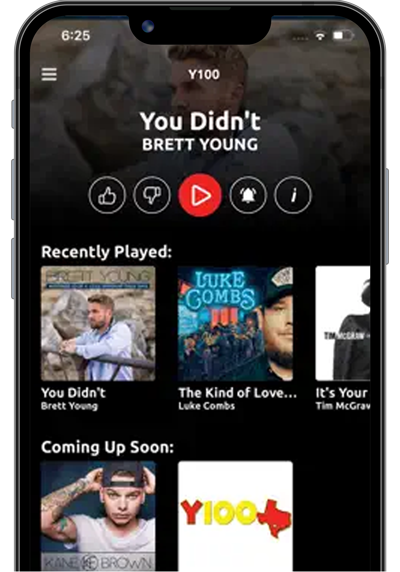

Ticketmaster has an FAQ page that explains how to register on a taxpayer’s information and if or when you will receive a 1099-K.

There is a push in Congress to revert the threshold back to $20,000, but Fox Business reported that it is unclear if changes could be made before tax filing season. There are other proposals that would have the threshold at $10,000 for 50 transactions, The Wall Street Journal reported.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/E2TLHOEMDFHU3DR35V7S7IR7NI.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/RAVT2737ZNDBRFJFRQMFIOMGI4.png)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/D7PYHYIYPRBBBISOLFFBPY4IMA.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/25XULN54JVFCRNRXQYQTWTARVU.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/MPJOGJOAONGPLETJYBVGNKNELA.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/AO4S4L3L4RF2DL55LOWJYQEGVE.png)